Now that you've got your budget set up, there's not too much else you need to do with it for a few months. To keep it maintained, you'll just need to open your budget and categorize the transactions that come in.

That's all you gotta do at this point.

If you pay for things in cash like I'm going to be doing for the next few months, add that transaction manually.1

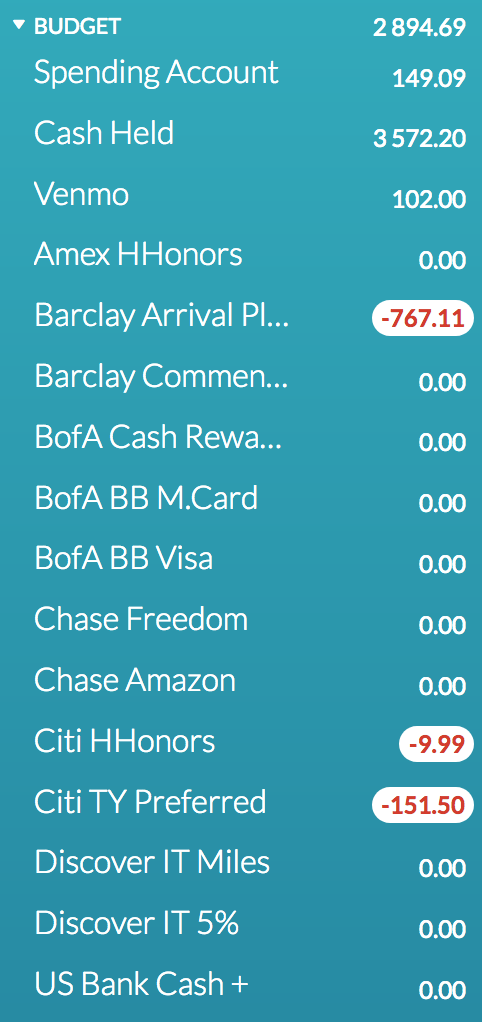

And then, as you go about your days, exchanging points for goods and services, the numbers on the screen will change.

From these numbers, you can run some nice reports. But since we have less than one month's data, it won't be too helpful at the current time.

But it might be fun to look into it anyway, just for fun... To see how January is going...

...

Huh, where did you come from?

Huh, where did you come from?

You may have noticed that since last time, my cash balance has increased quite a bit. Well, it's because I decided to focus my efforts on dealing drugs as my side hustle. Curiously, most of the clients insist paying in cash even though I have an account with Square to take credit and debit cards.

Just kidding. I sold my car and closed a Bank of America checking account I had opened due to a marketing incentive.

One thing I'm gonna have to do is deposit some cash into Spending Account because I don't have enough funds to cover all of my credit cards...

One thing that happened to me when I started budgeting was that I changed my spending habits because I knew that they were now being tracked and I wanted to drive my monthly spending number as low as possible, so that I could reach my goal faster.

I actively tried not to spend money

Things that made me do this was starting a budget at the same time as I set a spending forecast for myself. I had no idea how much I was spending each month, so my spending forecast was calculated by making intelligent assumptions and educated calculations.2

I took $21 000, which is some number, divided by 12, and burned the resulting monthly figure of $1 750 into my brain.

Every time I bought something, went out to eat, filled up gas - did anything that required money, I unconsciously thought about how much I could spend until I hit 1750.

I was doing calculations in my head each time I pulled out my wallet, and it got to be pretty stressful.

If I came in one month way below $1 750, then I would feel great about it, but then I would spend way above $1 750 the next month - as if I were rewarding myself for my hard work of saving last month.

At the end of the year, the number became like a self-fulfilling prophecy, my total spending was $21 101. I felt great - I had hit my number! It was a great feeling. I had set a goal and hit it exactly on the nose.

But looking back on it, I realize it was quite an unimpressive accomplishment. It had caused me so much stress that I often hated this budgeting thing that I had started. Whenever I spent a lot of money, I dreaded opening up my budget to find a large transaction to gategorize.

Going out with friends stopped being as fun. I didn't want to travel as much. I didn't want to buy anything, and things that I did buy but didn't end up really needing, I kicked myself because I had wasted money.

$1 750 became the goal.

My advice to you now is to not have a number as your goal, because it has the power to give you a significant amount of stress when it's really just a number on a peice of paper.

Although, at the end of the day, I will say that it change the way I thought about money for the better. I learned that living in a penny-pinching mode was not healthy, and that I would like to have zero worry when I reach into my pocket to pay for something.

In more hindsight, $21 000 wasn't challenging enough. If I had set my number to $17 000, I probably would have hit it because things work in funny ways.

Try not to do that

This is the way I'm doing it this time. I don't want to go through the same thing as before, so I'm not even setting target amounts for any of my budget line items this year. I hate being in a cage - I want to be free to spend wherever and whenever and on whatever I choose. I think there are much, much better, healthier ways to figure out whether to spend on something than how much it hurts the budget.

Just think for a second about the mentality that builds. If you don't do something you want because it doesn't fit into a rigid budget category, what happens?

You're saying, "there's only so much money in my life, and I need to save for the things that matter" and end up building a self-defeating scarcity mindset, when you'd much rather want an abundance mindset.

If you think it will add value to your life, you should be able to get it without thinking about your budget. There's a whole digression we can go on here about what that means and why abundance is better, but Robert Kiyosaki is better equipped to talk about it than myself.

Besides, the budget cannot get hurt, but it can hurt you.

This would have been an interesting thing to do because I would have been able to see what my spending habits were like before my mind got all caught up in hitting the number goal. I don't have an easily-accessible record of how I used to spend or think about money before I started budgeting.

I could go back and try to put something together from old credit card statements, but I have closed the checking accounts so my debit card transactions would be missing. Plus it sounds like a great deal of work that would only yield an "oh, that's interesting." Looking at the past isn't always worth it.

This method is better because after a few months, you'll automatically get a solid understanding of where your money goes, without having to worry about a monthly target number.

But, that doesn't mean that you wont eventually get stressed out about it.

Remember, your budget will force you to see where your money is going, whether you like it or not.

The good part is that if you don't like it, it's just a problem, and a problem is very easy to solve if you know it exists.

Conclusion

Because you have decided to start budgeting, it doesn't matter what choice you make here at all. Just like choosing what budgeting software to use in the previous step, just pick one. No matter what you do here, you'll reach the same place at the end.

Here you have two options, so a coin would work just fine.

Because you have already started, there is little that can throw you off track. The added benefit of subsequent decisions being less influential on your journey is also nice.

The best decision you made was deciding to keep a budget, then taking the first step to get it going.

What you should do for this step

Open your budget every once in a while and categoriize your transations.

Other than that, just keep being the best person you can be.

Whenever you're ready, you can move on to the next step.