On July’s last Thursday of 2015, I went my local Volkswagen Dealership in hopes of sealing the deal on a new 2015 Golf S TDI.

I wanted dark grey.

They didn’t have it.

The sales manager said that there was ONLY ONE 2015 manual TDI S left in California.

It was in LA and it was silver.

Not what I wanted.

He told me that if I commit and pay for the car now, they would have it shipped up overnight for pickup tomorrow.

You know the saying “If it sounds too good to be true, it probably is”?

There’s another saying that goes “If it sounds too complicated, it probably is.”

I went along with it, but I didn’t believe it.

I excused myself, went outside and dialed my other local Volkswagen dealership and asked if they had the car I wanted in stock.

“You mean the super dark grey one? Yup.”

“If I come down right now and get it, could I drive off with it today?”

“Yup, no problem. I’ll bring it out so it’s ready when you get here.”

The sales manager came out to get me to sign the paperwork.

I told him that his dishonest tactics cost him a sale (what? a salesperson might lie to get you to buy? No way!) and made my way down to the other dealership just in time for closing and bought the car for $21,212 plus plus.

I drove out of the dealership that night with a feeling in my stomach – part ecstatic about my new toy (read: commuting machine) and part uncertain about the trigger I had just pulled. Why the hell did I just do that? I don’t need a new car, I already have one and it drives perfectly fine.

I was also thinking, “Haha, I showed that other dealership to be not honest.” Little did I know…

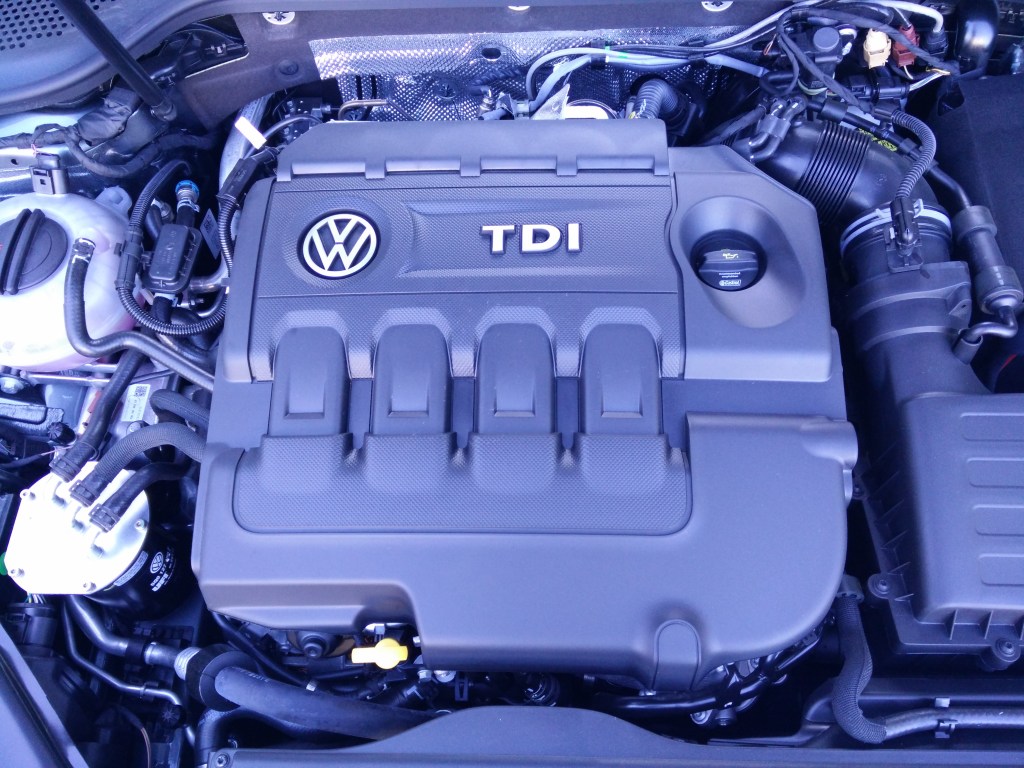

Two months later, Volkswagen got hit with the DieselGate scandal and everybody who had a TDI engine went crazy and called for blood, restitution, and lawsuits.

My dad advised that I sell the car ASAP.

“Go back to the dealer and demand that they take the car back! They lied to you about the car! You should go ask for your money back!”

I didn’t. It didn’t make sense to me to rush anything.

I had a feeling that today’s headlines would fall off the radar for everybody except TDI owners.

It did – by the new year, nobody was talking about it anymore, except the EPA and TDI owners.

If I could see the future, I would have gone and bought up as many TDIs as I could from people who now lamented their cars because a company was dishonest to make sales.

Why? Because in October 2016, the courts ruled that Volkswagen would be required to offer buybacks to all customers with affected cars, and these buyback offers were incredibly generous.

I got a buyback quote for $22,729 – more than the sticker price I paid – a deal too good to let go.

Now you might be saying –

“WOW, you had a car for a year and you’re getting MORE money back than what you paid for it? You made a profit!

You’ve basically been driving the car for free this whole time.

That’s incredibly lucky.

I should have bought a TDI last year.”

If I had a penny every time someone said that, I would have approximately $0.46.

Have I been driving this car around for free?

No. Not at all.

While I’m getting $22k back for the car that cost me $21k, the part people forget is that cars cost a lot more to own than the purchase price.

And no, it’s not just fuel.

Insurance, maintenance, commuting time – everything needs to be included if you want to truly see what you’re paying, or else you just trick yourself into thinking that you spend less than you actually do.

I wish I could live in the fantasy land where I made $1,517 on the whole ordeal, but this is reality land and things are different here.

In this post I will detail the real cost of my car to provide an answer to the retrospective question:

- Would I have been better off keeping my old – but perfectly functioning – car?

I’ll do this by sharing exactly how much I have spent on my car, from pickup to dropoff.

I will say, I do agree that I was lucky to nab a VW TDI just before the scandal broke.

It’s an incredibly fun, powerful, spacious, and efficient car that can torque your socks off.

Yes, you should have bought a TDI last year.

At least for now – we’ll see what the approved emissions fixes do.

Initial Purchase

This is what I paid at my local VW dealership when I picked it up:

| Item | Cost ($) | Notes |

|---|---|---|

| 2015 Golf S TDI, 4 Door Manual | $ 8,000.00 | I agreed to pay $21,212 for the car itself. $8k was the initial down payment. |

| Ding Shield | $ 795.00 | This a warranty that protects your car from dings. If you get a ding, they will come out and fix it for you. This was upsold by the finance manager, and I bit. |

| VW Care | $ 149.00 | Free 20k and 30k service. |

| VW Care Plus | $ 719.00 | Free 40k and 50k service. Bought these packages because I was thinking that I would own this car for as long as I could. That was my smart financial decision - drive it till the car falls apart around the engine. |

| Extended Service Maintenance Contract | $ 2,702.00 | Another upsell - Extended warranty contract. Apparently new cars break all the time and are super expensive to fix, that’s why buying warranties in addition to the factory warranty is the best decision you can make. At least that’s what the finance manager said. Funny, didn't the sales guy just tell me how reliable this car is? |

| Auto Butler Contract | $ 1,295.00 | The only upsell item I found myself not being able to cancel. I still kick myself for being gullible enough to purchase this. |

| Document Processing | $ 80.00 | Incremental margin. |

| Sales Tax | $ 2,032.00 | Yay, taxes! I love doing my part and giving money to the government so they can pocket most of it. |

| DMV Transfer Charge | $ 29.00 | The transfer charge isn’t that bad. |

| License Fee | $ 138.00 | License agreement to use the car’s technology. |

| Registration Fee | $ 91.00 | Shiny scratch and sniff license plate sticker. |

| CA Tire fee | $ 8.75 | Fee for buying tires in CA. I did purchase tires with the car. They were already installed. |

| Fuel this period | $ 0 | My first tank was free! |

| Total: | 16039 |

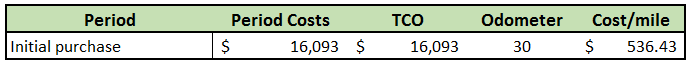

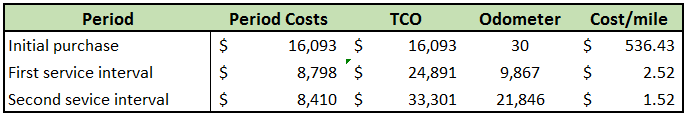

And that’s it! Let’s keep track of the stats in a neat table:

That first mile the purchase cost a whooping $536. No wonder cars lose so much value the moment you drive off the lot.

If you have an upcoming car purchase coming up, here are some wise nuggets:

Negotiating the purchase price of your new car

If you don’t know exactly what car (trim and features included) and a max price you’ll pay before you start talking price at the dealership, you’ve lost the battle.

You’re going to pay much, much more than what you would with a bit of preparation.

If you don’t do this basic preparation, you’re basically telling the salesperson “Hi, I have no idea. I’m an emotional buyer because I don’t do research and you’re welcome to take advantage of it. How much should I write on the check?”

Don’t tell him that. Instead, prepare.

It’s easy to prepare.

Take the amount of time you think it’ll take and divide by 50.

- Know how much you want to spend. This is easy. How much money do you have? As a guide, take your liquid net worth and divide by 10. That’s the maximum amount the FS says you should spend on a car and I wholeheartedly agree. You can increase this number if you’re going to finance it and you want to keep yourself poor. I know you won’t follow this rule (I didn’t) but if you do, you’ll be much better off (I know). Don’t let financing screw with your mind. I think it’s reasonably OK to finance it if you can pay cash for it and your interest rate is below the yield of a 10-year treasury bond, otherwise known as the risk-free rate. Otherwise, you can’t afford it.

- Know exactly what car you want to buy. This includes trim level and all options. This step is the most time consuming because it requires the most research. You’ll probably have to make a couple trips to the dealership, do some test drives, and some online research. It’s important to do step 1 first as that lets you eliminate cars that you can’t afford.

- Find how much the car can be bought for. This part takes 10 minutes tops. Use a search tool like cars.com or autotrader.com to search all of America for the car you’ve decided to buy. Use the advanced search function. Set distance to ‘any.’ Sort by lowest to highest price. Tack 10% off the lowest price you find and use that as the starting point for your negotiations. Don’t only use sites like KBB or TrueCar for this – these sites are in bed with the dealers, not you. (TrueCar makes it easy and fast – because dealers loves easy and fast money.)

Ok, since you’ve followed these three steps, you know can be certain that the price you pay will be within this range:

Price you found in step 3 (floor) < Price you will pay < How much you want to spend (ceiling)

During negotiation, be hard. Don’t let any details change about the car, don’t let the salesperson say “This other model falls into your price range.” If you haven’t done step 3 for that other model, you’re moving into unfamiliar (read: losing) territory.

Remember, car salespeople are great at what they do. You can’t beat them at their own game. But as long as you follow these steps to prepare, you’ll pay a price that you are happy and comfortable with.

If you hit your ceiling, thank the sales people for their time and start leaving. If the salespeople don’t stop you, shake hands and thank them for their time – they can’t sell you the car at that price.

What do you do then??

Two options:

- Repeat steps 1-3 above. Adjust your expectations and find a car that you can actually afford.

- Go back and offer more until they accept your offer. If you are OK with going against your own strategy.

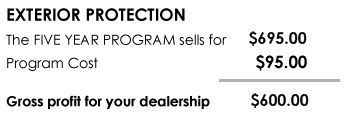

Auto Butler

-->

-->I’m calling this one out specifically because I feel so incompetent to have thrown money away so easily. I’m sure none of you are going to be as dumb as I was and buy this from the dealership. It’s specifically designed to make the dealership more money by getting you to come back to the dealership every 6 months for five years for them to do a basic wash and wax job.

But wait, there’s more! While you’re there, your car will receive a complimentary 715-point inspection. The service person will be trained to tell you that your car needs some stuff replaced without it actually needing that stuff replaced. You’ll probably accept because, hey, they know these cars! So they charge you to ‘re-place’ the part – take it out, put the same part back in.

But it’ll keep my car protected because their wax machine is magic and applies wax in the most efficient and deep fashion.

No, it doesn’t. Go to your local car wash place and pay $100 for a wash and wax every so often. It’s the same thing, if not better. Or, buy what you need to wash and wax your car yourself. Why would you spend so much on a depreciating liability?

But I want the comfort and security of taking my car to the dealership. They know what they’re doing and it’ll protect my car for the long run.

The dealership loves you for thinking like this.

That gross profit is just the beginning.

Go poke around on their site if you’re curious: autobutler.com; click the button on the right to log in to the dealer portal; enter ‘000000’ as the dealer ID. They don’t even try to hide their business model from you.

Other upsells – Extended maintenance contracts, ding protection, wheel protection, etc

These are basically the same as Auto Butler.

They’re designed to make the dealership more money.

They’re not designed to help you save money.

When you’re sitting in the finance manager’s office, you’ll be told this is the only chance you’ll have to get these great offers. That’s not true. You don’t have to decide right away. You can buy them at a later time.

These upsells – just like the car – are negotiable. The list price is too damn high. Just take a look at the Auto Butler program I bought. It’s MSRP is $695 and I got suckered into flushing $1295! I didn’t even think to think that I could negotiate these upsells. It’s a bit harder to do research beforehand on these though, so you should:

Ask for the contracts for anything that you’re interested in. The text on them is really tiny and faint so take your time reading through them. Read everything first before you make a decision. If you decide you want to purchase one, make sure you understand how, and if, you can cancel when you come back to your senses.

Shop around. You don’t have to purchase the contract from the same dealer either. There are many companies offering the same service and they will compete for your business.

Finally, remember that you’re buying additional protection for a depreciating liability. If you decide to purchase an upsell, seriously think about what value it’ll add to your car.

You might think that you’re protecting the resale value in case you decide to sell the car later. But it’s more likely that you’ll be able to pay someone a one-time fee to bring your car up to your resale standard that’s much, much lower than the upfront price you’d pay for these contracts.

Initial Purchase → 10k Oil Change

Here’s what the my car cost up till the first oil change:

| Item | Cost ($) | Notes |

|---|---|---|

| Extended maintenance service contract refund | $ (2,702.00) | After reading through the contract, I realized it's not worth it for two reasons: (1) Most of the stuff it covered was already covered by the VW factory warranty that is included in the purchase price. (2) The process to get reimbursed sounded really complicated, and many people complained on BBB that the underwriting company would try to get out of reimbursing you. |

| Car Payment | $ 8,369.62 | I paid down half of my loan on the first payment. Why not? |

| Car Payment | $ 381.38 | . |

| Car Payment | $ 381.38 | That extra stuff the finance manager sold me increased my monthly payment quite a bit. |

| Car Payment | $ 381.38 | |

| ScanGauge II | $ 130.00 | Mounted this on my dashboard so I could see engine values. Why? Why not? |

| VCDS | $ 269.81 | This diagnostics cable allowed me to make some pretty cool changes to the coding of my car, like make the gauges sweep, open windows with the remote, turn off the annoying seat belt reminder, and turn off ESC. I could also use it for diagnostics if I ever had to take the car in for repairs, so I'd know what the problem was before going into the shop. Worth it, I think. |

| Car Payment | $ 175.81 | The refund for the extended service maintenance contract came in, and VW credit did a recalculation of my monthly payment so that I'd still be on the 60-month payment plan. Everybody likes free money. |

| Car Insurance Refund | $ (306.15) | For cancelling the insurance on my previous car, I got a pro-rated refund. Nice! |

| Car Insurance | $ 769.97 | The refund was instantly eaten by the new insurance bill. |

| Car Payment | $ 175.81 | |

| 10k Maintenance | $ - | Free with purchase of car! |

| Oil Purchase | $ 11.45 | Buy some after the oil change in case I need to top up. |

| Fastrak | $ 25.00 | I drive across bridges. |

| Blackstone Oil analysis | $ 28.00 | Sent an oil to BlackStone for testing. Check out the report. Because of this, I decided I could push the maintenance windows a bit wider, so I'd have my 20k service done closer to 22k miles. Could have pushed it out even longer actually. |

| Fuel Cost this period | $ 706.71 | I recorded 9,357 miles at 37 MPG. |

| Total: | 8798 |

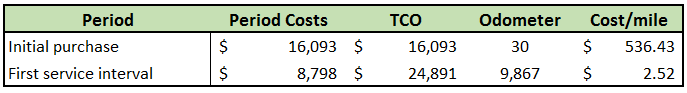

There’s nothing too interesting here, but the costs are adding up quickly.

The first thing I did after purchasing the $2,702 extended maintenance contract was to cancel the $2,702 extended maintenance contract.

I also paid down a large chunk of my loan. I’m not sure why I did this. I had cash sitting aroundcash sitting around and I hadn’t a better idea of what to do with it.

At this point, I had barely driven 10k miles, my TCO is just about to top $25k. If I had not paid such a large chunk of my loan, this period’s cost would have been closer to $1000. But at least I’m not paying interest on that amount anymore!

Adding the data to the table:

Blackstone Oil Analysis

I’m not affiliated with BlackStone. They’re not paying me to talk about them. They don’t even know I’m writing this. I think they have a good service to offer if you want to keep track of how your car is doing.

Sending your oil to BlackStone for analysis is like getting a blood test done for your car. They check for all kinds of metals, contaminants, additives and other things that collect in your car’s engine oil – it could be a useful tool for detecting problems early if some values are way off. They compare your numbers against the numbers of others who have the same car.

If you’re interested in extending the maintenance window like I was, they’ll provide you guidance there as well.

Their website: http://www.blatofckstone-labs.com/

10k service → 20k service

Hold on, this one is going to be a bit longer:

| Item | Cost ($) | Notes |

|---|---|---|

| Lug Nut Caps | $ 7.63 | I thought I had lost them. Turns out I had just misplaced them. |

| Car Payment | $ 175.81 | @ReducedRate |

| New Tire from Pothole | $ 142.76 | I ran over a pothole and had to get my tire replaced. Ugh. |

| Engine Coolant | $ 26.71 | To cool the engine. |

| Distilled Water | $ 1.59 | To mix with the engine coolant. |

| Measuring Cup | $ 7.60 | To precisely mix the engine coolant and distilled water. |

| Car Payment | $ 175.81 | To not have a loan shark chase after me. |

| Car Wash | $ 14.99 | The first time I got a car wash according to my records. |

| City Pothole claim | $ (142.76) | Bingo. It's quite easy to get this done. |

| Car Payment | $ 175.81 | |

| 20k Service Parts | $ 115.93 | 6qt engine oil, cabin filter, oil filter, washer DEF fluid. |

| VW Care Refund | $ (858.20) | Cancelled this once I realized I would not be keeping the car forever. |

| DMV Registration Renewal | $ 205.00 | Renew the shiny scratch and sniff license plate sticker. |

| Car Payment | $ 175.81 | |

| Fastrak | $ 25.00 | I drive across bridges. |

| Car Insurance | $ 813.40 | 6-month insurance premium. It went up! |

| Ding Shield Refund | $ (656.71) | Cancelled this too. Couldn't get a full refund because of what it said on the papers I signed. |

| Car Payment | $ 175.81 | |

| Car Payment | $ 7,290.81 | I paid off my car. The buyback was confirmed and I wanted to get the title. In hindsight, it would have been better to keep the payments coming and put this money into an appreciating asset instead. |

| VW Goodwill Package | $ (495.00) | Because we diesel drivers felt so bad about our cars that emit a little extra NOx pollution, VW gave us all a goodwill package. I cashed in the gift card for a money order at the post office. Lucky me. |

| Fastrak | $ 25.00 | I drive across bridges. |

| Car Wash | $ 21.95 | Second car wash apparently. |

| Oil plug | $ 2.28 | Forgot to get this earlier. |

| 20k Oil Change | $ 70.00 | I got my 20k oil change done at an independent mechanic. I had already purchased all the parts for some reason, so might as well not let them go to waste. Sometimes I wonder why I make the decisions that I do. |

| Oil for refill after leak | $ 32.00 | Right after the oil change, the filter gasket gave and all the oil leaked out... The guy who did my oil change came out to where I was stranded and put in a new gasket. I paid for the oil that was needed. Not sure why because it wasn't my fault, but I did. |

| Shipping for oil to BlackStone | $ 2.83 | USPS fee. |

| Fuel filter | $ 45.24 | Replaced the fuel filter myself. Purchased the part from dealership. |

| Blackstone Oil analysis | $ 28.00 | Check out the analysis. They said I could push the next interval to 15k miles. |

| Fuel Cost this period | $ 804.67 | Recorded 11,890 miles at 38.5 MPG - improvement from last time. Typical with diesel engines. |

| Total: | 8410 |

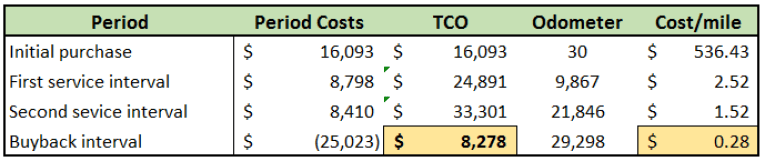

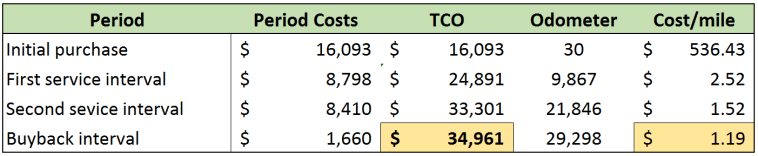

At this point I have had my car for a little over a year. It’s fully paid off with no major problems or repairs. And it’s cost me $33k.

Hey, at least my cost per mile is pretty low. Now it only costs $36 to drive to work!

Get your city to pay you for their negligence and corruption

Driving home one night, I drove my car over an unmarked pothole in the middle of the road and heard the unsettling CLUNK that was the wheel making contact with the road. I got out and observed:

Not a pretty sight.

I now had to get this tire replaced because I care about my safety.

I shopped around at a few tire change shops and got a few quotes (lucky me). I ended up getting the new tire at Costco since they were the cheapest option that

I found.

When I was paying, the mechanic told me I should file a claim with the city to get reimbursed for the damage. A buddy of his had hit a pothole just like me and filed a claim – the city sent him a check for the amount of the damage.

I thanked him, told him I’d look into it.

I was really thinking that this is another thing that San Francisco, a big city with millions of potholes that never get fixed, would make so time consuming and tedious that anyone who started the process would give up before they got their money. Why would they make it easy? SFMTA gives out bogus tickets all the time and people just pay them because they don’t want to deal with the hassle of taking time off of work to go fight their case.

Turns out it was way easier than I thought.

Here’s what you do to file a claim in San Francisco:

- Go to this website to download the claim form: sfcityattorney.org/claims/

- Read and follow the instructions on the claim form. For property damage, you’ll need to include two repair estimates in addition to the actual invoice. You should inlude pictures and any other documentation that supports your claim. Keep in mind that the city is going to try to find a technicality or an error you made to get out of paying, so make sure you follow all the instructions exactly. If your case is super compelling but you forget to include a required, but seemingly irrelevant detail, your claim will be denied.

- Send your paperwork in to the address on the claim form.

- Don’t feel bad. Think of it as a tax on your city’s negligence and corruption.

If your claim is accepted, you’ll get your reimbursement. My check came within a month.

Here’s what you do to file a claim in your city:

- Go to this website.

- Figure it out.

20k service → Selling car to VW

The last time I drove this car – the drive to the dealership to accept the buyback offer – it was pretty easy. Completely different from the feeling I had when I first drove the car out of the dealer parking lot. I thought I would feel quite sad about saying goodbye, but I didn’t. I had already come to terms with never seeing it again.

The Golf had served it’s purpose in my life. Lots of good times, hard times, joy, frustration, near-death experiences, scared passengers, carsick passengers, awe-filled passengers, and dashcam footage had made the experience something that I would miss.

But there wasn’t anything compelling me to keep the Golf. I had left my job so I didn’t have a commute anymore. My next job would not require a driving commute. Thinking about maintaining it, moving it to avoid parking tickets, and the $4600 I spent in OpEx alone in 2016 didn’t help the Golf’s cause at all.

Golfen had been a great car that served me well.

When I signed the paperwork that sold him to VW, I took a final look at him, gave him a thumbs up, then walked away without looking back.

The sidewalk I went down was a dead end. I ran across the street to the other sidewalk before oncoming on-ramp traffic because I didn’t want to walk back to where he was parked and look foolish.

In a few years I’ll pull a CarFax report on the VIN to see what he’s been up to.

| Item | Cost ($) | Notes |

|---|---|---|

| Notary Public | $ 10.00 | What's the deal with these things? You have to go to a person that has a license to witness your signature. A certified signature observer. |

| Engine oil | $ 10.30 | The oil needs engine, am I right? |

| Clothes and stuff | $ 277.23 | The other part of the Goodwill package all 2.0L TDI owners got was a $500 worth of credit to be used only at VW dealerships. I had money left on it so I bought clothes. |

| VW Dealer Card | $ (494.49) | The amount I was able to use on aforementioned dealer credit card. |

| Fastrak | $ 25.00 | I drive over bridges. |

| Business License | $ 93.32 | I obtained a business license from the SF treasurer to drive Uber. My thought here being that I would turn my car into something that could generate income, rather than just being a big sinkhole. |

| Metromile | $ 4.63 | Switched insurance to Metromile because I was not commuting to work anymore. |

| Fastrak | $ 25.00 | Other people drive over bridges. |

| Uber 2016 | $ (325.02) | The amount I earned driving Uber before taxes and expenses. |

| Turo 2016 | $ (446.60) | The amount I earned from renting my car out on Turo. The number of miles people put on it was too much though. |

| Insurance Refund | $ (39.48) | Pro-rated refund for cancelling policy. |

| Fastrak | $ 25.00 | I and other people drive over bridges. |

| Car Wash | $ 9.00 | Third car wash? |

| Metromile | $ 86.55 | Insurance bill. |

| SFMTA Citation | $ 110.00 | Uber and SFMTA don't have a great relationship, and drivers pay for it. This citation was for double parking. Scene: 2:05AM. Bars and clubs just kicked all their paying customers to the curb. Everyone looking for a ride (mostly on their phones). Cars double parked all over the street waiting for people to look up from their phones to actually see the car. I make a pickup. A month later, I get the citation in the mail. I didn't get it at the scene because 'drove away.' SFMTA sucks. |

| Car Wash | $ 13.95 | Fourth car wash! I'm on a roll. |

| Turo 2017 | $ (288.50) | Turo earnings. |

| Uber 2017 | $ (1,893.60) | I hit 100 rides and got the $700 signup bonus. A friend signed up using my referral code so I got anther $400. So really I only earned $793 from my own driving. Combine this with the 2016 earnings above, and it's about $1100 for just over 100 rides. I'm planning to analyze my time spent driving for Uber in greater detail in another post to offer some insight into how much you could earn if you do it half-assedly like I did. |

| Metromile | $ 56.63 | Insurance bill. |

| Metromile | $ (28.89) | Insurance refund for dropping the Golf from the policy. |

| Buyback - Golf S TDI 2015 | $ (22,729.13) | VW bought the car back for this price. Not bad, EPA. Not bad at all. |

| Fuel Cost this period | $ 476.15 | Recorded 5,447 miles at 33.7 MPG. City driving kills MPG. |

| Total: | $(25,023) |

Not bad! This pushed my TCO down to $8,278

Well, I cheated. I included the buyback amount, and the money I made driving for Uber, and the rental income from Turo, and the $1000 credit I got because of VW’s goodwill package.

Had I not included income figures and kept the car, the table would look like this –

– making OpEx for this period align more closely with the other periods (keep in mind that the first and second service intervals included large loan payments) and gives a better understanding of how much the car would have cost if I still had it.

I bought this car for $21k plus taxes, fees, and a bunch of unnecessary upsells.

$21k was the number that stuck in my head of how much the car cost.

The OpEx that I had accounted for was fuel. But this car easily gets 40 MPG so it’s not going to be much.

I basically ‘forgot’ about everything else (insurance, maintenance, general upkeep, tickets, etc) because I ultimately made an emotional decision. I WANTED this car, so the money fell out of my wallet.

Had I kept my old car that got 18 MPG, I would have happily been driving around at less than 22¢/mile today.

Compare that to the 28¢/mile I finished at with my new car even after buyback, Uber income, Turo income, and the Goodwill package.

I would have spent about $6,600 to this day on my old car, as opposed to $8,278 with the new car. $2,000 in savings doesn’t seem like much to trade for a wonderful driving experience, but there’s a huge opportunity cost in tying up $33,000 in a car.

An opportunity cost I figure to be at least $6,000. That’s a lot for me at this point in my life.

Yup, I would have been quite a bit ahead.

But here’s the funniest part: had I known that a $21k car would end up causing over $15k in ‘other costs’ within two years, I still would have bought the car.

Why?

Because I wanted it.

My old car was running great. I spoke to the person I sold it to just last week – it’s still going strong with over 302,000 miles and counting.

Why did I buy a new car?

Because I wanted something new.

I wanted to feel like a good American and throw away my disposable income.

I wanted to drive into the parking lot at work with a shiny new toy and impress people with the fantastic torque.

Ah, there’s Captain Hindsight flying overhead again.

Estimating the TCO for your new car

So, then the question is, if you’re going to buy a car, how do you know in advance how much it’ll cost you.

You don’t.

Just kidding. Turns out you can get estimates from all over the place.

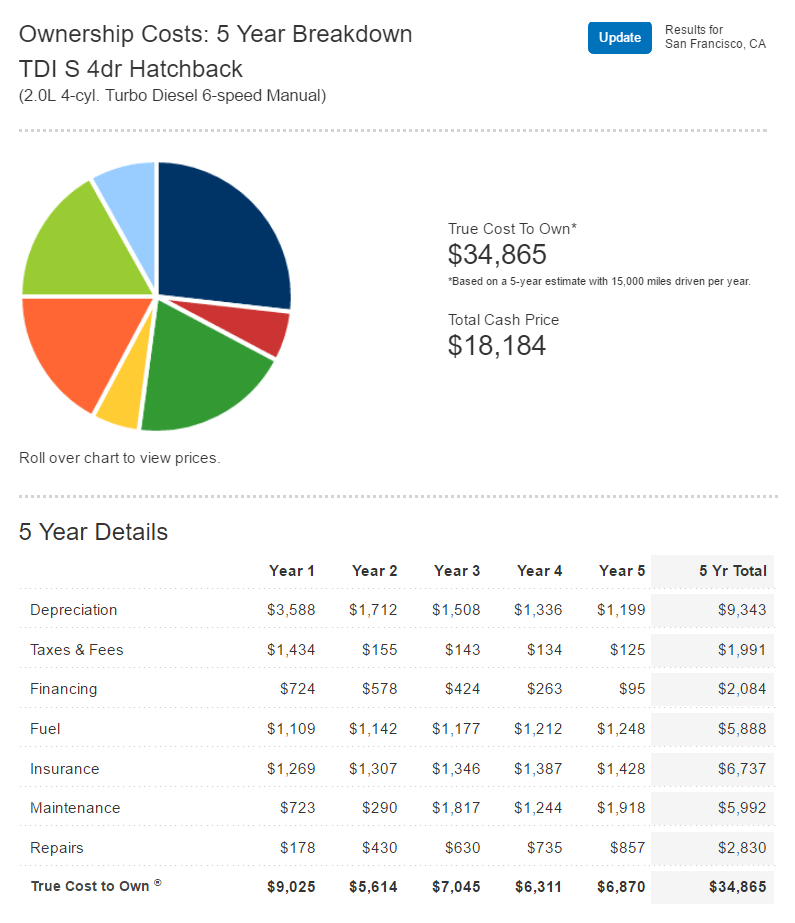

I went and pulled the 5-year cost breakdown of my car from Edmunds.com for comparison. Their estimates seem to be pretty on par with what I just detailed.

Take a look:

Some differences:

I did not include depreciation in my calculations.

Edmunds does. It’s the biggest cost in year 1 for a new car.

I fully paid off the loan on my car early in year 2.

Edmunds assumes that you finance $18k with $0 down because you want to pay an extra $2,084 for your car.

Being a 23 year old male living in San Francisco, I’m statistically more likely to get into an accident than anyone else, so my insurance costs more.

Edmunds assumes you’re an average person whose insurance is subsidized by 23 year olds.

Accounting for the differences, their estimates come surprisingly close.

Anecdotal evidence suggests that you can trust these numbers.

It’s almost like people have figured this out already, and you can learn from them. What a concept! If only I had known…

My next commuter

TCO coming soon.