By now, you should have defined precisely what it is that you want, figured out roughly how many points you need to make that happen, and come up with budget categories.

If you haven't completed those steps yet go back and do them before moving on.

This will be here when you are ready to continue.

Next, we are going to make our budget, figure out how much we need every month, and set up a system that will guarantee success.

I don't use the word guarantee lightly. If you set up your system right, you will get there. If the system fails, it's a shitty system.

We're not going to set up a shitty system. We're going to set up a system that is guaranteed to get you to where you need to be in order to get the things you defined in the first step.

The only way you can fail is if you get to the finish line and don't take the next step.

You can get everything perfectly set up, have everything ready to go, then get cold feet and do nothing. It might happen.

When I went through this two years ago, I had several bouts of doubt. I'll go through it again.

Is this really what I want?

Should I really go through with this?

I could just continue what I'm doing. My job is pretty comfortable, I'm well liked, and I think I'll get promoted pretty soon.

Going off into the unknown is scary, and many people have told me that I'm not making a smart decision...

The third point was a big one. It was the biggest threat to my following through, which, strangely, became the biggest motivator. We'll talk about that one and the others extensively after we've set up our system.

Research shows that the more specifically you define what you want, the more realistic it is, the more you want it, and the more likely it is that you won't get cold feet when the time comes.

That's why it's so important that you have completed the first steps.

Seriously - if you haven't done them yet, go back and do them.

Think for a second about what you defined in the first step. If you had everything you needed right now, what would you do?

Would you follow through?

If you said something like "Yes, but..." - GREAT! You're on the right track. Whatever came after the "but" doesn't matter. The most important thing you can do right now is start. Once you gain momentum, it'll be a lot harder for anything to stop you.

---

In step zero, I said that I was going to reset myself back to where I was two years ago in order to write about this in an effective manner. Part of that was to get my accounts back as close to zero as I could.

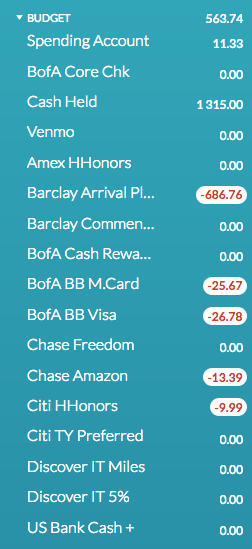

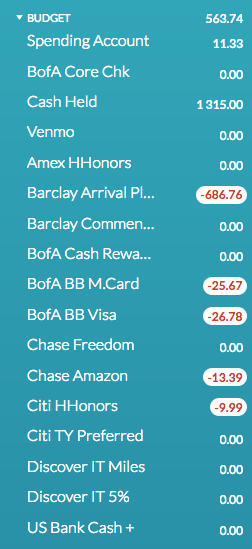

Here are the results of that:

Basically what happened: I moved what I had in Spending Account into another account.

Yea, that's about it.

I considered doing something with the cash I had on hand but it sort of made more sense to just use it until it ran out. You get asked all sorts of questions when you take cash to the bank in large quantities (even though what I have is not that large...). I'll just be using cash to pay for most things until it runs out.

Sidenote: It could be a fun experiment to see how paying cash for everything goes.

I've decided to close the BofA checking account. When I was writing the introduction, I forgot that having a checking account with at least $1500 in it to avoid the monthly fee only nets me $40/year. Without the checking account, I can still net $200/year with zero money tied up in a checking account. The rate of return on that is much, much higher.

More: The additional $40 I get represents a return of 40/1500 = 2.67%. This is just over the risk free rate. After realizing this, the argument for keeping the account was not compelling.

More: The $200 I'll still be able to net requires that I spend no more than $23, which is a WAY better 769% return. Lol, no wonder BofA discontinued the Better Balance credit card.

More: it helps me accomplish my goal of simplifying my life.

The money that I have in there will become cash, so that amount will jump when I go collect it.

There are a few things that look a little scary right now...

First, the amount that I have in my spending account right now won't cover my credit card bill.

About $500 of the charges are work-related expenses, and I'm expecting the reimbursement to come in soon. But that won't be enough to cover all bills.

I'd have to figure out how to get some of that cash into my spending account.

Second, I'm front-loading my 401k, so I won't even get any of my paycheck until the first week of March.

Good thing I kept cash in my mattress...

1. More details on this here. (Yea, this was a footnote in another post too. It's coming...) (go back)