The budgeting software I use just raised the price of their software. The price increase was justified because "[they] know it's worth the value it provides."

It was $50, and now it's $6.99 per month. 1

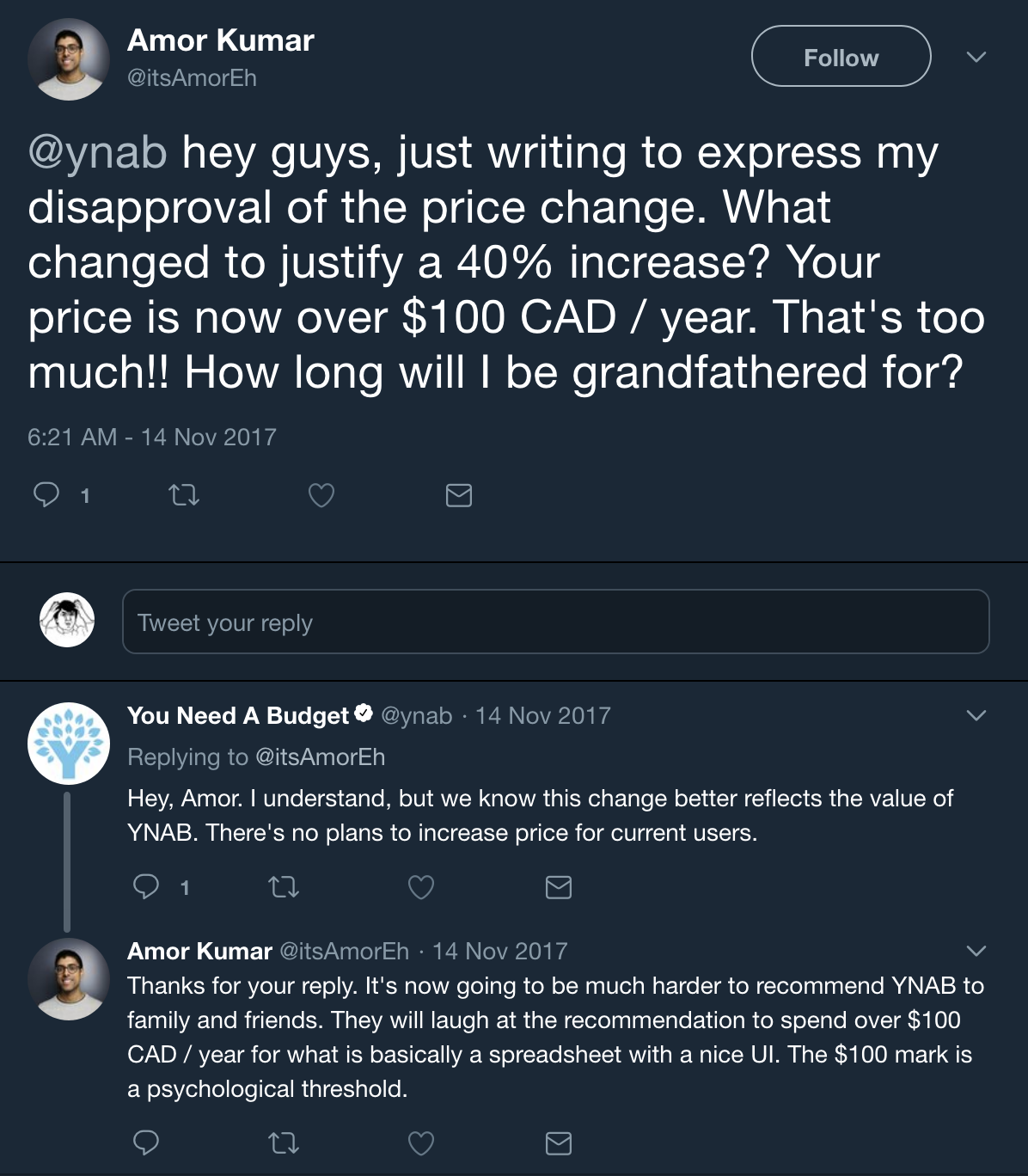

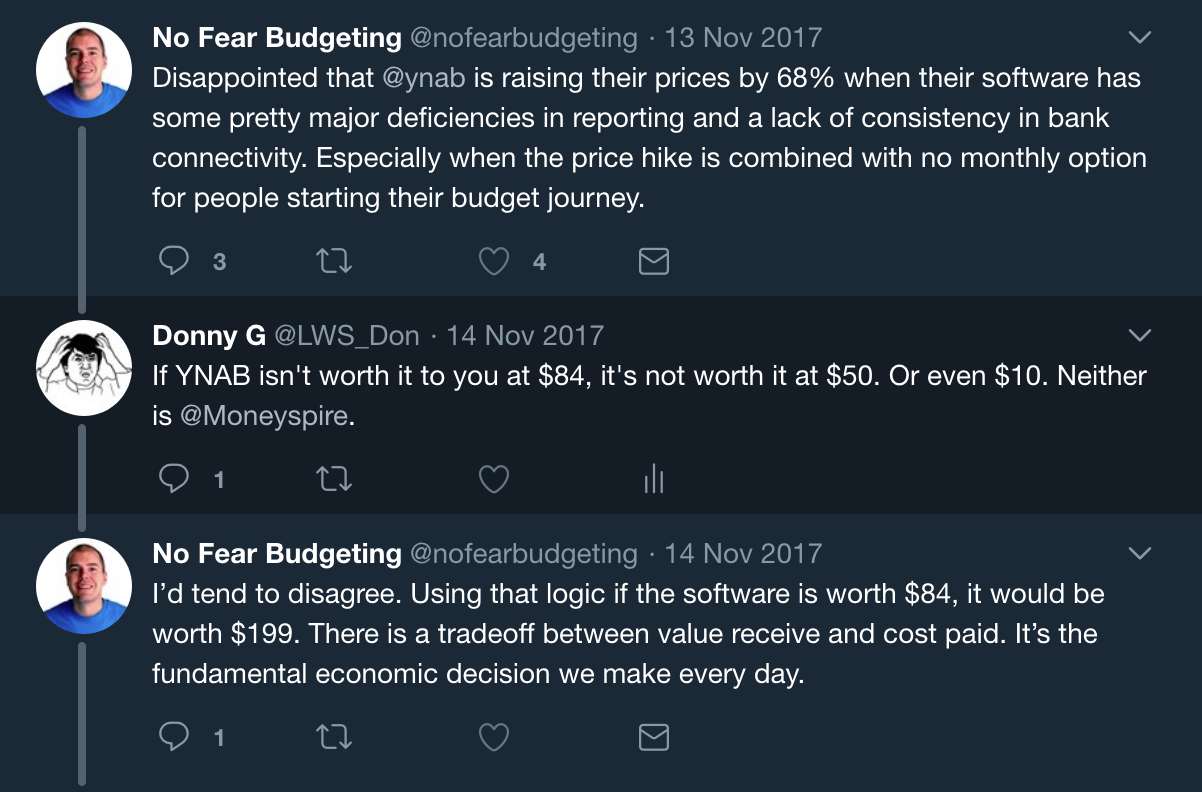

Unsurprisingly, some felt the need to protest:

Your family and friends won't buy at $50 either.

Your family and friends won't buy at $50 either. And they'll continue laughing at you

News of the price hike caused probably the smallest uproar on Twitter. Of course, some people will always complain about price increases because they need something to complain about. But what got me was that people were complaining about a $34 price increase for budgeting software.

$34 over the course of a year.

Using a percentage can help strengthen your point when the data would hurt it.

Ok, if you can't plan for an additional $34 for something that helps you reclaim your financial life and save thousands of dollars, then only one thing can be true: you suck at budgeting.

Or, wait, do you fear budgeting??

But, if you were a YNAB customer before the price increase, you'd still pay the same price you initially paid. So, this price increase only affects new customers, and if new customers pay $84 to reclaim their financial life and save thousands of dollars, my guess is that they would think their investment paid off several times over.

Here's what they said in response to a not-thrilled guy protesting on Reddit:

Locked in... for now, lol

Locked in... for now, lol

Even if the lock-in expires at some point and existing customers have to pay the increased price, we should all be able to figure out to come up with $34. Once again, if you can't, you suck at budgeting.

There's another fundamental economic decision that we make everyday that even people who budget seem to forget: what we do with our time.

Switching anything out comes with an upfront investment that is typically much larger than the reoccurring maintenance needed to keep it going. If you wanted to protest the YNAB price increase (not sure why you would though, you're locked into your rate... for now) and switch to some other budgeting software, there are a number of steps you have to take.

First, you have to find what you're going to use as a replacement. (Click here for tips on choosing a new budgeting software)

Then, you have to procure it, set it up, connect all your accounts, learn how to use the new interface, and get used to the new system.

All in all, I'd say a rough estimate of the time it would take me to switch to a new budgeting software - given that I have already picked one out - is three hours. I'd much rather pay an additional $34 over one year than spend three hours switching to another tool that does exactly the same thing.

I'm not saying YNAB is the best budgeting software for everyone. I heard about it from a friend and it has been the only budgeting software I've used seriously. If my friend had recommended a different tool and it got me what I needed, I would be saying the same about it. I wouldn't switch unless there was something that pissed me off so much about the product or it became unusable.

YNAB was in the right place at the right time, so they got my business. Kudos to the YNAB team for that. It's not easy to put your message in front of the right person at the right place at the right time AND THEN convert the person.

Anyway, just in case you are thinking of switching, and in the spirit wanting to help you out, I've put together a comparison between the popular free budgeting software Mint and YNAB.

I have used Mint before - so I already have an account with several accounts linked. But at this point, the list of accounts is out of date and will require maintenance to make it accurate again.

One of the reasons I like YNAB is that it forces me to categorize each expense instead of it trying to be smart and guess where it should go. I know my categories, my budgeting software does not. Mint does this. For me, a restaurant charge can fall into different categories, and Mint will classify everything as 'Restaurants' which means I have to find and change the automatic decision.

I don't like that it does that. However, I realize that I have not spent a significant amount of time with setting Mint up properly and learning the intricacies of the service. When I first used it, I didn't have the motivation to keep a budget. I didn't have a good reason to budget - I had a debit card and I could see my checking account's balance and I'm good at math. I remember feeling a bit overwhelmed at having to go in and make sure that the software was properly categorizing my transactions.

So I'm going to give it a second chance and give you my review at the same time.

And hey, if I like Mint better, I might just switch and save some money.

Watch out, YNAB!

Setting up

Since using Mint in college, I changed most of my passwords, so I'll start by updating that information. Then, I'll add any new accounts so I can do a true apples-to-apples comparison.

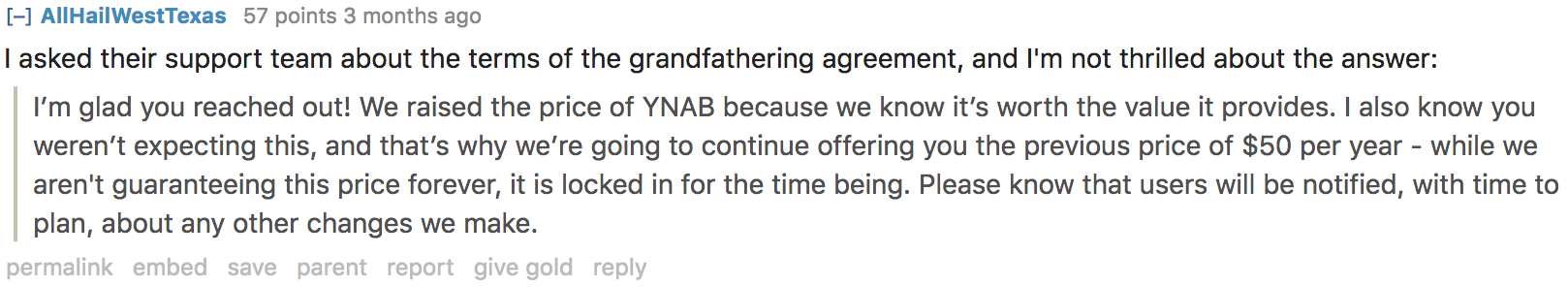

First, I'll connect my main checking account.

Your security is so important

Your security is so important

Hmm... I seem to not be able to add my new checking account... Let me try again.

It's the most important thing to us

It's the most important thing to us

Ok, how about a credit card account?

So secure we can't even connect

So secure we can't even connect

Ok, I'm not able to add my main checking account or a credit card. This is very inconvenient because I'm trying to do a comparison here.

Ah, hold on, I think I know what I might be doing wrong. My checking account is with Capital One, and they use an access code to connect with third party applications instead of a password. Security FTW! Let me go get it and I'll give it a try.

Still too secure

Still too secure

What the fuck...

Why am I doing this?

Am I really going to stop using what's working if I can accomplish the same thing with Mint?

It's not that I don't think Mint is a good budgeting software. I'm absolutely positive that I can get the same end result, and maybe even more, like a free credit score if I allow them to sell my data.

I already have something that works, and even if I do find that I like Mint more, go through all the trouble of switching, and move all dependencies to Mint, I'd basically be in the same place that I was with YNAB:

I'd know how much I spend each month.

Well, I'd be able to save $50/year on my YNAB license but the small amount of time I would spend switching would surpass that very quickly.

I deleted my Mint account.

Thank you for reading this review!

What have we learned?

Once you find something that works, keep it, don't fuck around with it any more. Focus on better things. Your time is valuable.

For me, it makes no sense to spend time switching out something that works.

If YNAB increases their price beyond $250, I'll spend the three hours making the switch during a fresh start.

1. Billed anually at $83.99. I hate when companies do this fucking asterisk pricing bullshit. Just tell me how much I have to pay upfront instead of trying to hide behind a smaller number. Why not just say it's less than a cup of coffee per day like all the other bullshit coffee-cutting bloggers do? But, I suppose when you're selling a product to people who are living to paycheck to paycheck, you gotta speak their language. Heck, $6.99/month might sound cheaper than $50 year.

(go back)