I've been meaning to get this up here for a while. National Preparedness Month has come and gone which means I have a month's worth of transactions to categorize.

I started fresh on a new budget at the beginning of the month, adding only notes to the items to jog my memory for proper categorization. I want to keep my budget as simple as possible, so I'll be categorizing transactions into only three groups,

- capital expenditures

- necessary operational expenses, and

- discretionary operation expenses,

which, together, will capture any type of expense. Whether it be a one-time furniture purchase, a once-in a while taxi ride, or the monthly rent expense, it'll fit into one of those categories. Notes will assist me if I want to do further investigation and analysis later down the line.

Here's what my budget looks like:

Simple is sex

Simple is sex

Whew. I've got $6 352.59 worth of expenses to categorize. It's sort of a scary number, because for the past more than two years, I've averaged less than $1 500/month. I just moved into a new apartment though, so I'm guessing that a sizable portion of that will be non reoccurring one-time capital expenditures.

I will keep another category for things I want to allocate money, like monthly investment amounts or buying a course. I will use the Investments category for this.

I will not track cashback or reimbursable expenses incurred by me on behalf of my employer.

Definitions

Before we begin, let's define the categories a bit further to help in categorization.

- CapEx

"money a company spends to buy, maintain, or improve its fixed assets, such as buildings, vehicles, equipment, or land." - Wikibebia. This definition is pretty good and can apply to my personal expenses. - Necessary OpEx

Repeating expenses that are an essential part of my life. On top of the things that I need to survive (food, water), things that I would not want to go without fall into this category (personal hygiene products, pens) - Discretionary OpEx

Repeating expenses that do not fall into necessary OpEx category. These can be avoided if money became an issue because I could live without them if I lost all ability to make money.

The purpose of breaking up OpEx into two categories is to determine the minimum amount I should keep in my emergency fund. I'm aiming for twelve months of Necessary OpEx.

Go

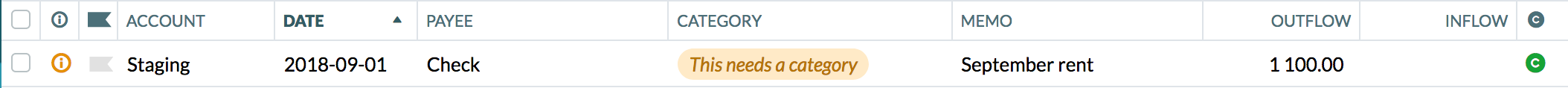

First expense of the month:

You could say I got pretty lucky to find a nice place in San Francisco for such a good rate. I was allocating $1500 for rent, then convinced myself that I would probably need to up that to $1800 for a decent place, then stumbled across something that worked out very well.

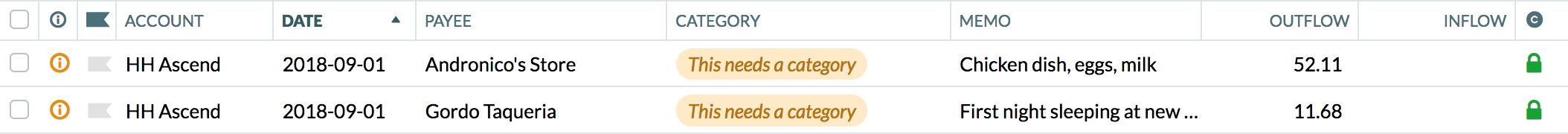

Next up are two food expenses:

While eating food is necessary, dining out is not.

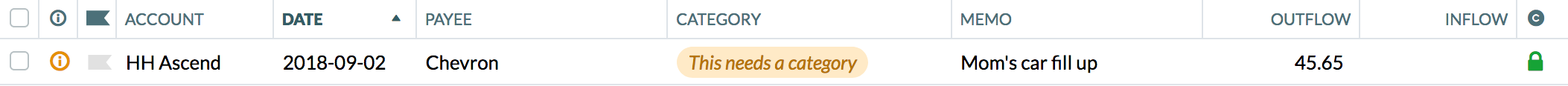

I topped up my mom's car after having borrowed it for a while. If I owned the car, I would consider this discretionary OpEx, but this is not something that will repeat consistently.

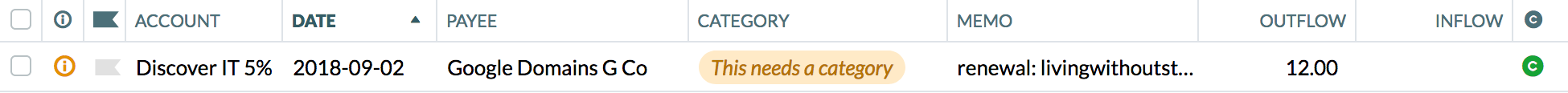

A bit broader:

Wow, it's been a whole year of LWS. I remember the epiphany of the name, then going to Google Domains to check if it was available in the wee hours of the morning. I thought, "man, there's so much stuff that people say that you need that you can live without. I want to make a site that helps people un-learn the lies they have been told."

This post is about how you don't need a bunch of categories in your budget.

This should really be classified as a business expense. Granted, I have no business income, so it won't really make much of a difference, but it seems like now is as good a time as any to start tracking this. I'll put it in a catch-all just in case my CPA can do something cool with it.

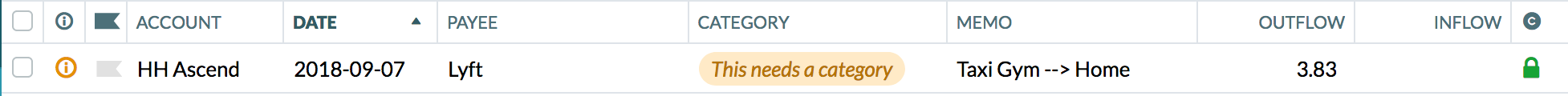

Transportation is necessary. There are many options available, including walking, biking, driving, public transit, and taxi.

If my bike was stolen, it's too far to walk, and I don't have a car, my options are taxi, public transit, or hitchhike. One of them is free, and one of the other two must be discretionary.

You could, however, make the argument that public transit is also discretionary, since you can walk, but I'm not going to go that far.

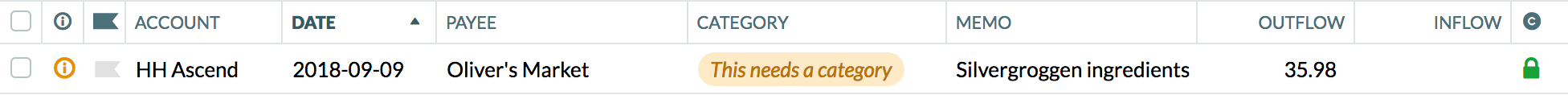

Ah, this one is tricky:

I bought medicinal ingredients (bourbon and lime) because I was starting to feel a little sick. Where does this fall?

It's not strictly a one-time expense because when I run out of bourbon or silver, I will buy more. It is a product whose consumption helps fend off sickness, but it is not absolutely necessary.

If my life depended on it, I would be able to avoid this expense, but I would not because the benefit it provides far outweighs the upfront cost.

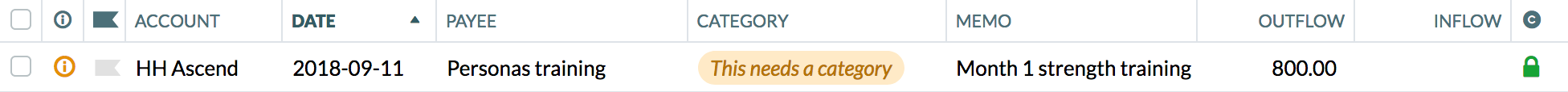

Getting stronger:

In my mind, definitely necessary. In my budget, the expense is optional.

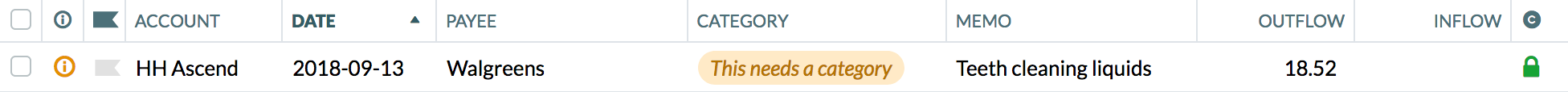

Oh yea. Definitely necessary. You wouldn't want to talk to me otherwise.

Hmmm.

Going out used to happen much more frequently than it does today. Three years ago, it would almost be a weekendly thing, now it happens once every few months, maybe. There is no improvement made to a fixed asset or physical good purchased attained from going out, so it won't be CapEx.

Parking.

A necessary expense if you have a car. Having a car is optional in my case.

Last one I'll show:

What is travel? It's not exactly a capital expense for the same reason going out isn't. It's not necessary for me to travel to LA, so I suppose the power of simplicity leaves only one option.